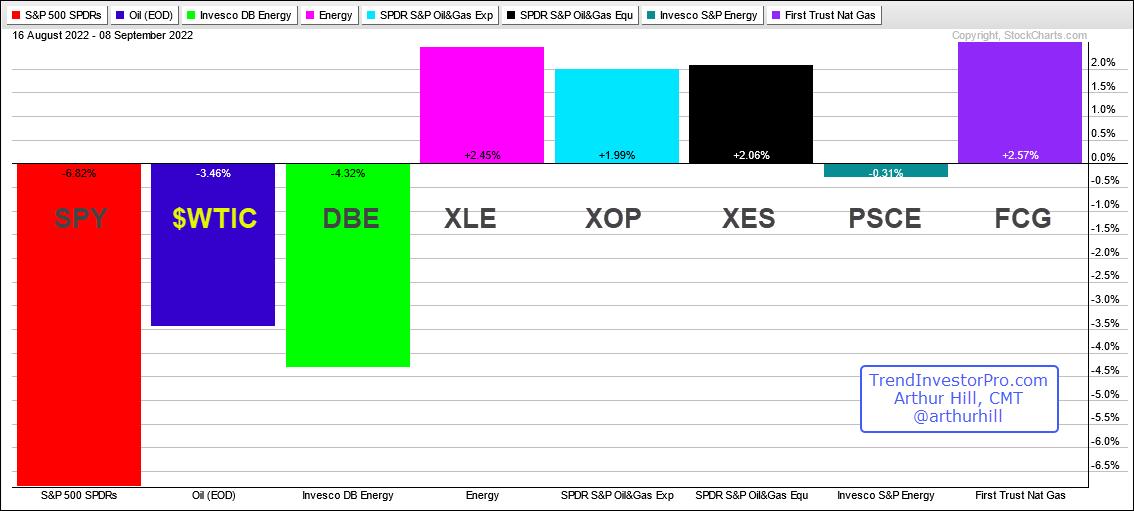

It has been a rough four weeks for stocks and oil, but the energy-related ETFs held up relatively well and remain in uptrends. The PerfChart below shows performance for SPY, oil, the DB Energy ETF (DBE) and five energy-related ETFs since August 16th, which is when SPY peaked. SPY is down around 6.8%, oil is down 3.5% and DBE is down 4.3%. One would expect the energy-related ETFs to also be down, but four of the five are up.

The Energy SPDR (XLE) and Natural Gas ETF (FCG) are leading because they are up around 2.5%. The Oil & Gas Equipment & Services ETF (XES) and Oil & Gas Exploration & Production ETF (XOP) are up around 2% and holding up better than the broader market. The Small-cap Energy ETF (PSCE) is down around .31% and lagging the other four.

The next chart shows the Energy SPDR (XLE) with the Trend Composite turning positive (lower window). There was a whipsaw signal in the second half of July because the pullback was quite deep. These happen. On the price chart note that XLE managed to firm after retracing around 61.8% of the December-June advance and broke short-term resistance on July 20th (red line). The Trend Composite followed with a bullish signal.

The blue line on the chart is the ATR Trailing Stop, which can be used to set a stop-loss after a signal. Using the Trend Composite signal, I set the initial ATR Trailing Stop just below the July low, which is support (dotted line). A 5 x ATR(22) stop means the stop is five ATR(22) values below the highest close since the signal. This stop rises when prices rise and flattens when prices decline, as in the last two weeks. A close below the stop or negative Trend Composite would warrant a re-evaluation. See the “plugin” link in the lower right to learn more about the Trend Composite and ATR Trailing Stop.

TrendInvestoPro remains very selective when it comes to stock-based ETFs because the broad market environment remains bearish. ETFs in favor include energy, clean energy, utilities and biotechs. In fact, we identified some short-term bullish continuation patterns this week in XLE, TAN, ICLN, XLU, XBI and IBB. Click here for immediate access to around reports, videos and strategies.

The StochClose, the Trend Composite, ATR Trailing Stop and eight other indicators are part of the TIP Indicator Edge Plugin for StockCharts ACP. Click here to take your analysis process to the next level.

—————————————