When I began investing full-time, my methodology’s foundation was based on William O’Neil’s CANSLIM® approach. It’s a deeply researched and proven strategy. The AAII’s own ongoing trading models validate that fact.

For the next three decades, my efforts were focused on how best to incrementally increase the probabilities of success for each of O’Neil’s attributes and to layer on my own enhancers. In reality, our book “Tensile Trading: The 10 Essential Stages of Stock Market Mastery” spotlights dozens and dozens of what I’ll label “Probability Enhancers”.

When you understand and embrace probabilities as an investor, you find that the emotional burden of losses and the exuberance of profits level out and become more manageable. Grasping probabilities facilitates you taking a present loss knowing that you are now one step closer to your next big win. As you read about my passages, tools and lessons, consider each in the context of offering you a “probability enhancer” which when diligently applied should outperform the market!

Passage 1: A Sell Discipline

It hasn’t been a cake walk, but I’ve learned to tame my two wild horses — my own inner fear and greed. The first stage was to believe my charts. Embrace that what they were telling me was indeed the truth. The second stage was to convince my ego to partner with me.

Early on, precious time was lost in this little negotiation as I tried to convince my ego to accept the charts reality before being able to pull the sell trigger. After years of effort, I’ve achieved the discipline to convince my ego beforehand to recognize what “wrong” looks like within each chart in each position I take.

When the charts tell me to sell, I don’t freeze or begin a new negotiation. I’ll react appropriately based on my previous sell scenario. It’s less stressful and I’m free to move onward — closer to my next winning trade. An investor’s mental energy is the fuel you run on. Vacillation and failure to promptly sell a loser consumes precious fuel that could be used instead on trading your next winner.

In his book, Trading in the Zone, Mark Douglas describes the four types of investor fears.

Losing moneyMissing an OpportunityLeaving Money on the TableBeing wrong

It’s essential that you address each one in detail in hand with your ego prior to entering a trade. Understand that this negotiation — this sell discipline — is meant to protect your profits and protect you from yourself. Without it, you are falling prey to the old cliche “shutting the barn door after the horse has bolted” — late to action and after the damage is done.

I have great respect for Jesse Livermore who I believe was a generational trader. His words remain with me. “My plan of trading was sound enough and won oftener thank it lost. If I had stuck to it, I’d have been right perhaps as often as 7 out of 10 times.” Even Jesse Livermore had challenges doing what he knew he should do. My experience is that there are two types of losses. The first type of loss is simply a result of the laws of probability and is to be expected even when you follow your methodology.

The second type of loss requires much more introspection and brutal self-honesty. Losses that result from ignoring your trading plan or similar bad behavior is what needs to be focused upon and minimized. There is no place for denial in successful investing. Buying is easy. You always have lots of company. Just google stock market books. The overwhelming majority of these books are all about buying. Don’t quote me on this, but intuitively the ratio of books on buying equities versus selling strategies is 1,000-to-1. It’s always been the way.

This is precisely why in our book, Grayson and I devote an entire chapter to selling methodologies and the requisite mindset and routines to succeed. Remember — your goal is to stay in the game. If you protect yourself on the downside from all the inevitable mini-panics, the rallies will take care of you. This is not the forum to dig into that here in detailed fashion, but I would encourage you to check out this blog I wrote: “Selling Methodology: 1 + 1 = 3” (October 16, 2015).

Passage 2: Seize The Free 1%

This is more an awakening versus a passage. I realized that there is a good deal of low hanging fruit that investors can gather in the way of finding an extra 1% and retiring early. Do the math; that’s all it takes. Investing is a game of inches. Yes, it takes only 1%, and if you start young, it’s a slam dunk. Warren Buffett is always talking about the magic of compounding. It’s absolutely true.

So where is the 1%? It’s all around you hiding in plain sight — simply there for the taking if you focus on costs and fees. This awakening is more of a mindset, an attitude to persistently consider costs, expenses and fees as an investor. I’m living proof that if you embrace my two mantras, you should outperform the market. (a) Embrace all my probability enhancers when you trade equities. (b) Embrace the 1% mentality. Find free money by simply minimizing costs, expenses and fees.

Let me say again that by embracing these two mantras, you should outperform the market. It’s mind-bending how higher fees and expenses create a slow burn of your assets over time. In addition, not acting defensively and thinking about tax minimization also vaporizes those same assets. Remain vigilant because the money management world is expert at enticing you to play the “shiny object game” which yields higher fees for them — lo & behold! It all comes out of your pocket.

Basic case in point: there are over two dozen ETFs that represent the S&P 500. The Vanguard ETF (VOO) has fees of 0.03% which is basically free. SPY— the SPDR S&P 500 is 0.095% which is three times higher. From there, other ETFs skyrocket to stupid expense levels and some investors buy them. It’s sheer madness. It’s the same S&P 500 Index! Look at the PerfChart of two S&P 500 index funds — SPY and RYSPX. They both hold EXACTLY the same equities. There’s no “expert stock picking” involved here. Had you invested $100,000 in 2003 in SPY and your twin sibling invested the same in RYSPX, nineteen years later you’d have $426,000 while your twin would have only $249,000. The difference would be caused entirely by fees. I’d say your twin’s investment in RYSPX is both sticky and stupid — but I digress!

About a decade ago in my class, I bought equal amounts of two identical gold ETFs. The only difference between them was that GLD (the more popular of the two with twice the assets) had 0.40% expenses. IAU is half the size and logically should have had higher expenses. But IAU came in with 0.25% expenses.

I recently sold both of these ETFs. The profit difference shocked me. I knew there would be one, I wasn’t expecting the dollars involved. IAU made me far more money. Do your diligence. It’s free money if you do — low hanging fruit which adds to your 1%. This blog is not the place for a granular description of all the low hanging fruit to save you 1% but I’ll briefly list a few examples.

Cash balances — pay attention! One click or phone call can move dollars from zero interest accounts to significant interest income accounts. Don’t ignore this free money.I’ve already given you an ETF example. With every ETF, explore alternatives. Try ETF.com.Mutual funds — don’t get me started! I’m not picking on American Funds, but they offer the exact same funds — in some instances under a dozen or more different ticker symbols. Why? To maximize front-end loads, 12b1 fees, redemption fees, expenses, etc. Beware of money managers that put you in the high fee funds (for their benefit) versus cheaper versions of the same fund.Advisor fees — 1% a year doesn’t sound like much, but you’d be stunned what it costs you over 10 – 20 years. And remember, all fees are negotiable. So negotiate and renegotiate as your assets grow.Think defensively. Think tax minimization. There’s a whole population of governmental professionals poised to think of new ways to get at your assets. A top tier estate planning attorney and accountant are a priority for all investors — not a luxury!

The bottom line: with minimal effort, you can make your money work better for you.

TOOL #1

An appropriate example of my “probability enhancer” approach is “Seasonality Charts.” This tool highlights stocks, ETFs and mutual funds tendency to perform better in some months and worse in other months on a recurring basis. (Check out the ChartSchool articles on StockCharts.com.)

In your arsenal of Asset Allocation rebalancing tools, put the winds of probability at your back by selling positions into the strongest months of the year (using Seasonality) and accumulating positions during historically weak months. Overtime, selling into strength and buying on weakness delivers profits. In this previous Traders Journal blog, I identified six equities with historically strong performances in December. A month later in this Traders Journal blog, I recapped the actual performance. This basket of six equities with favorable seasonality bested the market by 150% in December.

Seasonality works! A final example. I looked at four of the largest equities in the S&P 500 over the past 5 years: Apple, Amazon, Tesla and Google.

All have one month where they had positive price appreciation 100% of the time. Never down in that month.All have one weak month or more where either they have never experienced any price appreciation or have only one year out of the past five that had positive price movement for that month. Make probabilities work on your behalf.

To some of you, this might not seem like a seismic investment recommendation. But many investors see that seasonality is indeed a probability enhancer and multiple enhancers cumulatively add up to an appreciable growth in your bottom line.

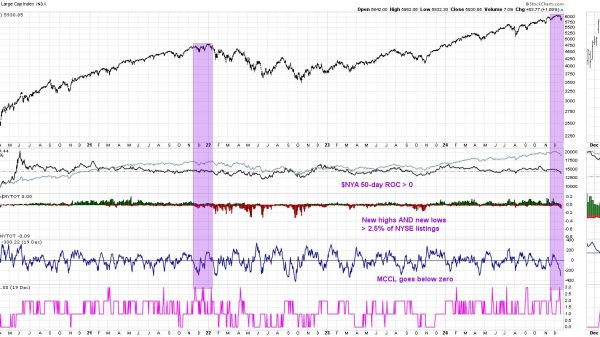

TOOL #2

There are great insights to be had when you focus on the power of varied time frames — analyzing the markets or an equity through a series of lenses, each one a tighter time frame than the previous. I call this methodology “telescope to microscope”. Aligning the trends in various periods shifts the odds in your favor. A corollary methodology applies the same principle top down. To further empower your investing probabilities, you only buy in an up trending market. Then look for the strongest sector. Since sectors are a collection of industries, you search out the strongest industry in the uptrending sector. Finally, you gravitate to the best-of-breed stocks in the strongest industry.

I have a pre-formatted chart style to help you.

FIVE LESSONS

Have a “sell strategy”. If you don’t, the market will assign you one and call it “KABLOOEY.” It’s both a cliche and a fact that “the first loss is the cheapest” and “mental stops don’t work.”Don’t buy 100% of your position all at once. Stage your purchasers in tiers. My personal rule is never to buy a second position unless my first position is profitable. I’ve witnessed far too many investors who try to catch a falling knife. They buy an equity at $20. It falls to $15, and they buy more — all the way down to bankruptcy. Think logically. If you bought it at $20 and it’s now $15, the market is telling that you were wrong. Stop being wrong! Don’t do more wrong. Ralph Vince has written a number of books on the mathematics of money management and risk analysis which unequivocally prove that pyramiding both into and out of a position (albeit selling faster than buying) is the scientifically proven optimal strategy. Here’s a link to a more detailed blog on the subject.Buy “Best of Breed”. I like my cars to be fast, reliable and luxurious so my ownership experience is 5-star. I’m the same with stocks. I buy the best because I want my positions to offer a similar 5-star ownership experience. I just don’t get it. Why would a pharmaceutical investor not buy Eli Lilly Co. (LLY) and buy Omeros (OMER) instead. I buy only “best of breed” equities because it’s not worth buying second or third tier companies. Yes, the price-to-earnings ratio is higher, but so is my peace of mind. Know your own bandwidth! Before I attended Wall Street University (i.e. I started trading) and paid lots of tuition to learn how to invest with consistent profitability, my holdings were vast in number. Too vast. After years of judiciously reviewing my winners and losers, I discovered my positive performances were directly coupled to having fewer positions. I now have 10 stocks, 10 ETFs and 10 mutual funds. I never buy or acquire a new position without first removing another. Having said that, if you have Bill Gates’ bandwidth, perhaps 20 is fine.Be Mr. / Mrs. Adjustable Elastic. The market is always right and the market is always changing. Yes, Mr. High IQ Big Shot — the markets demand compliance. I love to quote Charles Darwin. “It is not the strongest of the species that survives, not the most intelligent that survives. It is the one that is most adaptable to change.” Buy and Monitor — not Buy and Hold — is my mantra.

Finally, a little story. I had a finance professor in Business School who was renowned on Wall Street for creating the Sharpe Ratio, CAPM — The Capital Asset Pricing Model (including Alpha and Beta) and other common tools. Understandably, he won a Nobel Prize for his work. The point being, he was brilliant, cerebral and frankly sometimes on a totally different tier. He came to class one afternoon and rhapsodically described in fine detail this new theory he had developed. After what seemed like eternity, one of my classmates who had been an investment banker said, “Professor Sharpe, this is interesting but how do we make money with it?” To which Professor Sharpe replied, “I don’t know, but isn’t it cool?!”

My point being that investing attracts many brainy folks who wander off intellectually into cerebral frontiers that are indeed interesting but won’t help you become a better manager of your money. One prime arena I’ll point to is the hundreds of technical indicators that have been created where frankly most should be siloed since they only contribute to more complexity instead of profits.

p.s. I’m really looking forward to exchanging ideas and thoughts with you October 7th and 8th at ChartCon 2022. I hope you join all of us at this very special event! CLICK HERE for more information and to register.

Trade well; trade with discipline!

Gatis Roze, MBA, CMT

Author, “Tensile Trading: The 10 Essential Stages of Stock Market Mastery” (Wiley, 2016)Developer of the “Stock Market Mastery” ChartPack for StockCharts membersPresenter of the best-selling “Tensile Trading” DVD seminarPresenter of the “How to Master Your Asset Allocation Profile DVD” seminar