Wash, rinse, repeat. We’re seeing a scenario very similar to what we saw last Thursday, when the Consumer Price Index data was released. Today’s Producer Price Index (PPI) also showed signs that inflation may be cooling. The softer-than-expected October PPI number was news that may further boost investor confidence. The year-over-year number was up 8% vs. an 8.3% estimate; when you strip out volatile food and energy prices, PPI went up 6.2% year-over-year vs. a 7.2% estimate.

Overall, the data is encouraging and leans toward the possibility that perhaps the Fed may slow its pace of interest rate hikes. As of now, the CME Group’s FedWatch tool shows an 80.6% likelihood of a 50 basis point rate hike when the Fed meets on December 14. But there’s a long way to go before the Fed thinks about pausing rate hikes. Inflation is still here and needs to be a lot closer to the Fed’s target rate of 2–3% before we see any pause in rate hikes. Until then, it’s likely that rates will continue moving higher.

Treasury yields fell on the news with the 10-year Treasury Yield ($TNX) falling to its 50-day simple moving average (SMA). The U.S. Dollar Index ($USD) also plunged and traded close to its 200-day SMA.

One interesting dynamic coming from the stock market’s reaction to a cooling inflation number is how the stock market tends to move up strongly on encouraging news. The Fed’s goal is to bring down inflation by raising interest rates. This is expected to slow down growth, which, in turn, should cool the stock market. But if equities move up sharply on news of the cooling inflation, could it impact the pace of future interest rate hikes? That may be something to keep an ear out for in future Fed meetings. So it’s not yet time to hold a pivot party.

And speaking of inflation, retail sales are front and center in investors’ minds this week as major retailers announce earnings. This is a good indication of consumer spending habits during inflationary times, especially as we approach the biggest shopping season.

Retail Earnings Underway

Walmart (WMT) and Home Depot (HD) both beat earnings this morning, which was another encouraging sign. WMT saw an uptick in grocery sales and is also sensitive to changes in consumer behavior during these inflationary times. We’ll see earnings from Target (TGT), Lowe’s (LOW), and TJX Cos. (TJX) tomorrow. WMT and TGT made it to the SCTR Reports today.

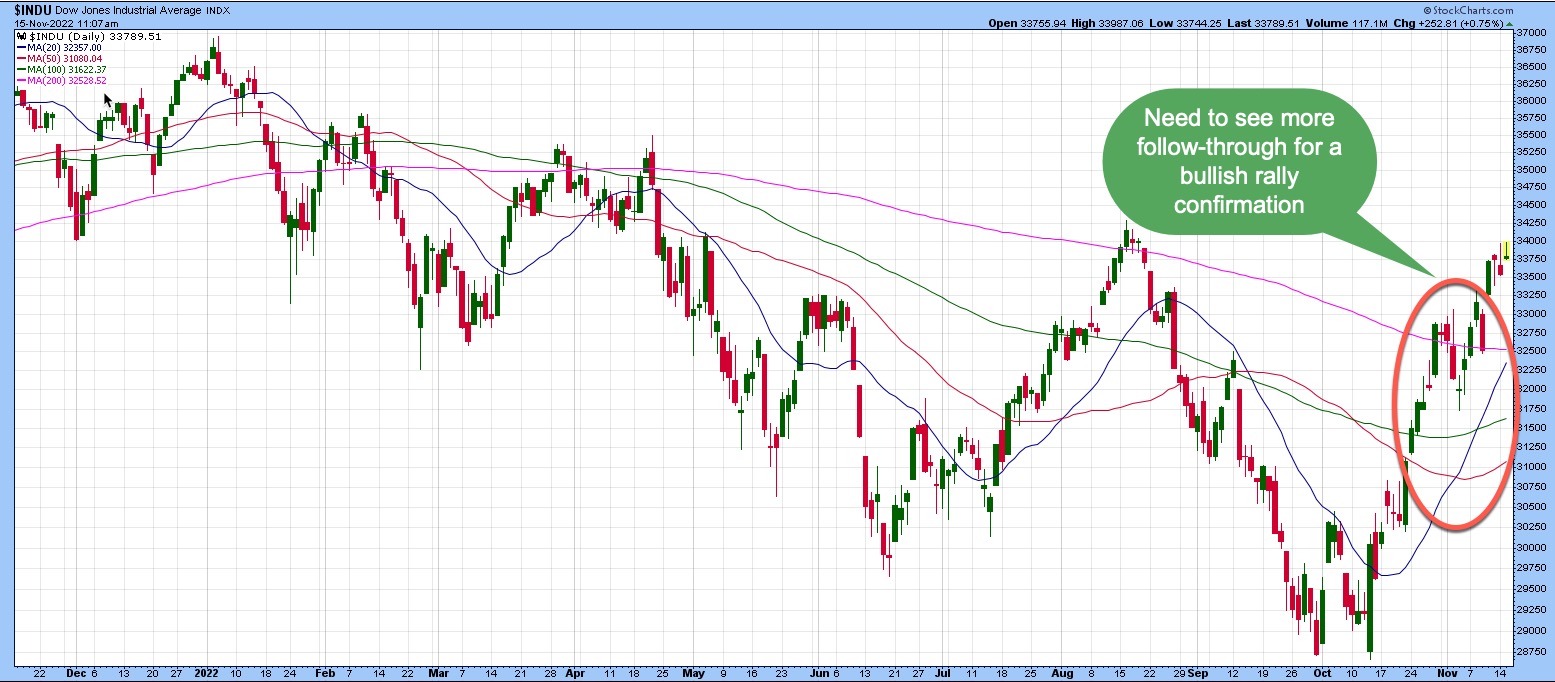

Wall Street liked what it heard as stock markets continued their recent rally. The Dow Jones Industrial Average ($INDU) is coming close to its August high, a level that could act as a resistance level (see chart 1).

CHART 1: WILL THE RALLY SUSTAIN? The Dow Jones Industrial Average ($INDU) is trading close to its October high, which could act as a resistance level. The 50-day SMA needs to cross above the 100-day SMA and the 200-day SMA needs to turn upward before we can think of a sustained bullish rally.Chart source: SharpCharts from StockCharts.comAlthough the $INDU is rallying, we still need to see the 50-day SMA cross above the 100-day SMA before we can even think of a sustained bullish rally. And the 200-day SMA should move upward. The S&P 500 Index ($SPX) and the Nasdaq Composite ($COMPQ) rallied and are following a similar pattern as $INDU. And Bitcoin ($BTCUSD) also rallied, although it’s still very bearish.

The Horsemen of Risk

Gold, bonds, and volatility aren’t not doing much today, which could mean that investors are more complacent. Any change in complacency is likely to show up in volatility first, so keep an eye on the CBOE Volatility Index ($VIX), as it seems to be hanging around the 23 level which, in this volatility regime, suggests the markets are more complacent. But that can change on a dime, so it’s worth keeping a close watch on $VIX.

The bottom line: The stock markets may be rallying now, but they’ve been making significant up-and-down moves a lot lately. The best you can do is be prepared.