From The Sector Level

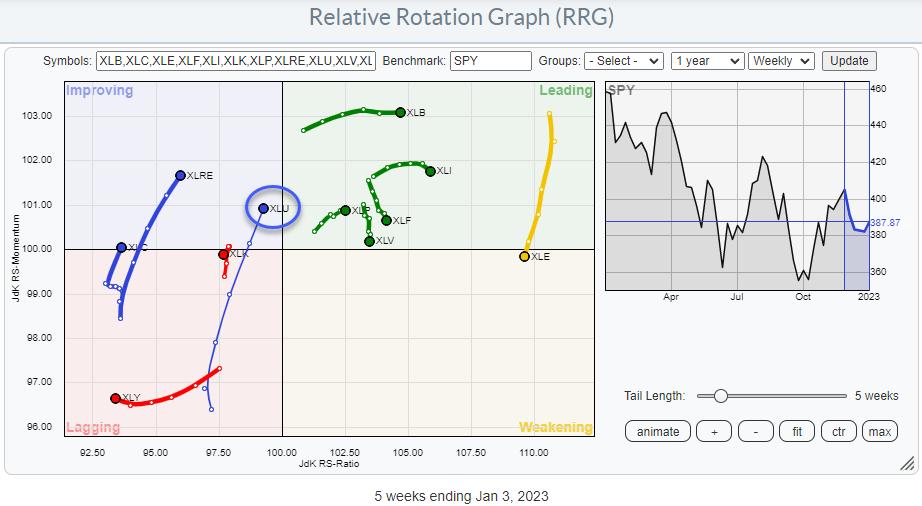

On the Relative Rotation Graph for US sectors, the tail for the Utilities sector stands out.

It is relatively long compared to the other tails on the graph, which indicates that there is quite a bit of power behind the move. With the tail moving from lagging into improving and heading toward the leading quadrant, this sector deserves some attention.

On the daily RRG, XLU has moved from leading into weakening. However, the sector is still at the highest RS-Ratio reading on the daily time frame. With the tail being medium length, there is plenty of room to curl back up before hitting the lagging quadrant.

Working from a scenario of strength with the weekly tail being the most important driver, I am watching for the daily tail to start curling back up and getting back in sync with the positive rotation, as seen on the weekly RRG.

Utilities and Consumer Staples and Healthcare are generally seen as the defensive sectors in the stock market.

The RRG above carves out these three defensive sectors against the S&P 500 index. The overall strength of this segment is well visible.

Healthcare has led the way over the past weeks and is now taking a break with a rotation lower but is still at the highest RS-Ratio reading. Consumer Staples continue to head deeper into the leading quadrant, while Utilities are shaping up for a renewed rotation into the leading quadrant. When XLU crosse over, we, once again, have all three defensive sectors inside the leading quadrant or at least on the right-hand (positive) side of the Relative Rotation Graph.

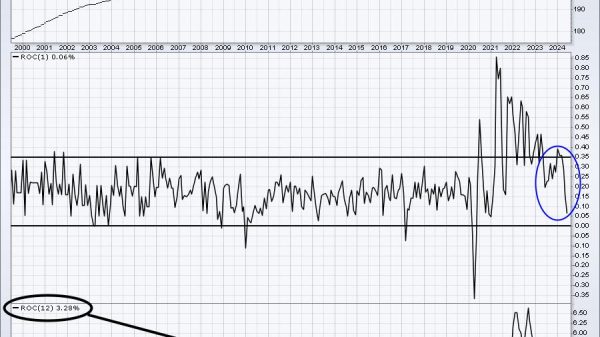

On the price chart, XLU has rallied back to the old support line, or the support zone between two rising support lines, which is now running into resistance. old support becomes resistance. Especially when XLU can get back above that zone and back into the old rising channel, a lot more strength is expected. I.e., move above 72 with confirmation when the sector returns above 74.

Down To Groups

From the Sector Summary page, we can grab the RRG that shows the rotation for the various groups inside the Utilities sector.

We can see more detail when looking at the rotations for these groups against XLU as the benchmark. The first observation is that $DJUSWU (Water Index) has been leading the charge over the last months, but this group has now started to lose relative momentum while still being on the highest RS-Ratio reading. As it is currently going through a setback, the upside potential is limited here, while there is some clear near-term downside risk.

Conventional Electricity is the weakest group in this sector and should therefore better be avoided. The same goes for Gas distribution, whose tail just rolled over inside the improving quadrant and is now underway to lagging again.

The only group currently picking up relative strength is Multiutilities ($DJUSMU), inside the improving quadrant and heading toward leading.

The RRG-Lines are picking up, with RS-Momentum already above 100, albeit flattening. The RS-Ratio is improving and heading towards that 100-level.

On the price chart, $DJUSMU is consolidating after a rally out of the October low. Moving out of that small range to the upside, i.e., above 250, will open up the way for a higher move, with some intermediate resistance expected around 257, the level of the most recent peak.

A strong confirmation of the build-up in relative strength will be triggered when the raw RS-line breaks above its most recent high.

All in all, the sector continues to pick up relative strength. Multiutilities seems to be the next group to lead the sector, while water remains strong but seems to go through a setback, and conventional Electricity is a drag.

Enjoy your weekend and #StaySafe, –Julius