You don’t want to miss Mish’s 2023 Market Outlook, E-available now!

Ahead of Thursday’s CPI inflation print, the stock market rose on Wednesday, extending previous gains for the week. The stakes for the Fed-critical report are high, since most investors expect a lower CPI Print.

Apple, Microsoft, Alphabet, Amazon, and Tesla all had gains on Wednesday, potentially signaling a modest recovery in tech in the works, or they could all plunge tomorrow. As we ring in the Year of the Rabbit, investors have high hopes for what this new year can bring to their portfolios.

I recommend reading Mish’s 2023 Outlook – a must-read resource that forecasts macroeconomic trends, markets, and commodities and is an enjoyable read!

With the Federal Reserve’s expectations set that inflation will return to its target rate of 2% in 18-24 months, media coverage has recently been focused on this narrative, which is far from reality. There is no consensus on how much the US will grow, nor on how deep a recession might be felt. Energy prices have relaxed for now, which is positive. Shelter is 30% of CPI and trending higher. The prevailing narrative in the media today is that “inflation has peaked,” maybe, but it will not be 2% again for many years.

The shelter component is 30% of the total CPI calculation. Wages are going up. Food is soaring. Inflation will remain way above the Fed rate of 2%, and we will see if the CPI Print is softer tomorrow. It is positive if trending lower, but lower does not equal 2%.

With the end of 2022 and the turn of the New Year, investors must consider what lies ahead of tomorrow and beyond. As we enter 2023 the Year of the (Water) Rabbit – according to the Chinese zodiac calendar – many stakeholders will need insight to profit in 2023.

Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox. For more detailed trading information, contact Rob Quinn, our Chief Strategy Consultant, to learn more about Mish’s Premium trading service.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish and John discuss how equities and commodities can rally together, up to a point, in this appearance on Bloomberg BNN.

Mish and the team discuss her outlook and why inflation will persist, with a focus on gold, in this appearance on Benzinga.

While the weekly charts still say bear market rally, Mish and and host Dave Keller discuss the promise of the daily charts on the Tuesday, January 10 edition of The Final Bar (full video here).

In this appearance on Business First AM, Mish discusses the worldwide inflation worries.

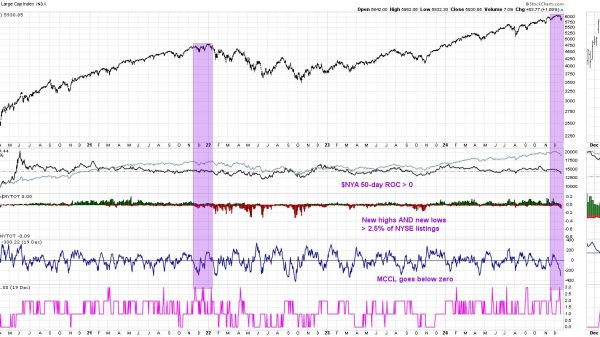

In this special StockCharts TV presentation, Mish teaches you how to use four simple and reliable key indicators to help you catch big swings in the market.

In this appearance on Business First AM, Mish discusses why she’s picking Nintendo (NTDOY).

Mish sits down with Gav Blaxberg for a W.O.L.F podcast on what she has learned as a trader and teacher.

In this appearance on Business First AM, Mish explains how even the worst trade should not be too bad with proper risk management.

In this appearance on Real Vision, Mish joins Maggie Lake to share her view of the most important macro drivers in the new year, where she’s targeting tradeable opportunities, and why investors will need to keep their heads on a swivel. Recorded on December 7, 2022.

Mish sits down with CNBC Asia to discuss why all Tesla (TSLA), sugar, and gold are all on the radar.

Read Mish’s latest article for CMC Markets, titled “Two Closely-Watched ETFs Could Be Set to Fall Further“.

ETF Summary

S&P 500 (SPY): 389 support, 401 resistance.Russell 2000 (IWM): 179 support, 184 resistance.Dow (DIA): 336 support, 344 resistance.Nasdaq (QQQ): 274 support, 280 resistance.Regional Banks (KRE): 56 support, 62 resistance.Semiconductors (SMH): 216 support, 224 resistance.Transportation (IYT) 220 pivotal support, 230 now resistance.Biotechnology (IBB) 127 is pivotal support, 138 overhead resistance. Retail (XRT): 68 now resistance.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education

Wade Dawson

MarketGauge.com

Portfolio Manager