Some economists have suggested that inflation results when the money supply expands faster than the rate at which goods and services are produced. They correctly point out that this expansion of the money supply will generally lead to rising prices. But what most economists fail to mention is that inflation can exist even when prices are stable.

Stable prices can mask underlying inflation in cases where, absent an increase in the money supply, prices would have declined. In fact, for most of the nineteenth century, at a time of great industrial and agricultural expansion, prices did indeed decline. Price declines were then considered normal—the result of greater efficiencies in production and distribution—and a benefit of the Industrial Revolution.

In fact, during the latter part of the nineteenth century, the US economy grew “at the fastest rate in its history, with real wages, wealth, GDP, and capital formation all increasing rapidly.” And this occurred at a time of falling prices!

Efficiencies in power generation, production, and distribution resulted in the manufacture of more and better goods, which led to a reduction of the hourly work week. Prices fell as less labor, materials, and energy were required to produce and transport goods. At the same time, workers’ real wages rose, enabling them to markedly improve their standard of living.

It should be noted that the United States’ economy was able to accomplish this feat with its currency closely tied to gold and without an income tax or a central bank. According to economist Milton Friedman, the 1880s produced the highest rate of growth in reproducible, tangible wealth per capita of any ten-year period. Real annual growth for that decade was 3.8 percent.

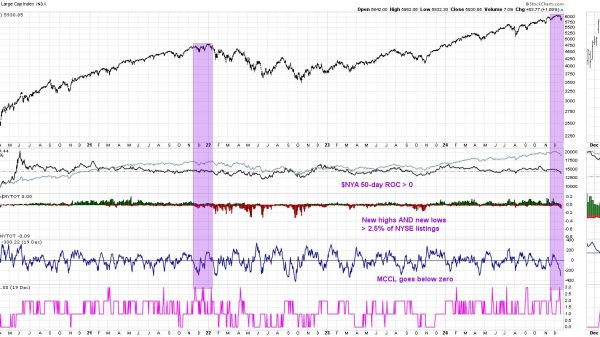

As can be seen from the chart below, there was virtually no inflation during America’s first one hundred years—except for a brief period during the Civil War when the US government resorted to printing greenbacks. Inflation began in earnest after World War II because of the abandonment of the gold standard for domestic purposes in 1933 and skyrocketed in the early 1970s, when the US abandoned the gold standard for international settlements.

The average annual inflation rate since 1913 has been 3.42 percent. Because rising prices are the flip side of a depreciating currency, one must wonder how soon before we pay eight dollars for a gallon of gas or four dollars for a loaf of bread?

Today, we have come to see price increases as normal, and fret when, in rare instances, general price levels actually decline. As economist Murray Rothbard pointed out, any increase in fiat money over the quantity of gold is inflationary. As a result, even when prices are stable, inflation may be at work, robbing us of the benefits of improvements in technology, production, and distribution.

Inflation also discourages saving because even a relatively low rate of inflation destroys the value of money. The Federal Reserve System’s stated goal is to maintain an annual inflation rate of 2 percent. But even this seemingly low rate of inflation eats away at the value of dollar-denominated savings accounts: a dollar discounted at the rate of 2 percent a year will only be worth eighty-two cents in ten years, sixty-seven cents in twenty years, and just fifty-five cents in thirty years. Faced with this prospect, the would-be saver gives up or is forced to take outsized risks to counter the corrosive effects of the Fed’s monetary policy.

To be sure, inflation produces winners as well as losers. Those who get to spend the new counterfeit money first (before the inevitable rise in prices) benefit. Included in this lucky group are those the government deems “too big to fail.” Debtors benefit because they get to retire their debts with “cheap” money—and of course, speculators who are able to game the system benefit. The rest of us, especially those on a fixed income or who are trying to save for retirement are punished. It stands to reason that if some are too big to fail, there must be others too small to care about. Which group are you in?

The Fed has been managing (or mismanaging) our monetary system since 1913, and the US dollar had lost over 95 percent of its value as of 2000. That year, it took a buck to buy what four cents did in 1913, before the creation of the Federal Reserve System—the United States’ private central bank. Was that by design or by accident? I, for one, haven’t made up my mind, but it does not seem accidental. After all, who is the biggest debtor of them all and, therefore, benefits the most from cheap money and low interest rates?

HOW WELL HAS THE FED MANAGED OUR MONEY?

As of 2022, it took almost thirty dollars to buy what a single dollar could buy in 1913. That means that a dollar is now only worth 3.3 cents. The cumulative price change from 1913 to 2022 was a staggering 2,856 percent. Consider that a Ford Model T initially cost $825 when it went on sale in 1908. That’s today’s money equivalent of $24,750—the same car, but different currency!

The official inflation rate for 2022 was 8 percent (CPI Inflation Calculator). Most promarket commentators agree that official inflation rates have been jiggered to provide a more favorable patina to our failed fiscal and monetary policies. The government is slowly destroying what little remains of the value of our money. Perhaps one day soon, we will have to retire the US dollar and replace it with something else, the way Germany retired the inflated and devalued papiermark, first with the reichsmark in 1924 and then with the deutsche mark after World War II. With the conversion to the deutsche mark, Germans lost 90 percent of the value of their monetary holdings!

Of course, all this raises the question: Why do we need to expand the money supply at all? If four cents in 1913 could buy more than a dollar’s worth of goods and services today, why do I need a new counterfeit dollar to go shopping? Why not put the counterfeiting of new money aside and instead mint halfpennies to facilitate making change?

Murray Rothbard came to the insightful conclusion that “it doesn’t matter what the supply of money is. Any supply will do as well as any other.” He noted further that unlike an increase in the quality and quantity of goods and services, an increase in the quantity of fiat money reduces its quality and confers no general societal benefit. Fiat currency, having no intrinsic value, is simply a yardstick. Adding an inch to the yardstick so that a yard is now thirty-seven inches doesn’t make one faster, taller, or thinner—it just gaslights those who want (or need) to be fooled!

It would appear the Fed’s primary job is to counterfeit money for the US Treasury whenever the need arises—and the need has been arising a lot lately. This is done under the guise of “economic stimulus,” but I am not fooled by this ruse. Someone’s pocket is being stimulated, but it sure as heck is not mine. The Fed recently held about $9 trillion in paper “assets” consisting mostly of US Treasury notes, mortgage-backed securities, and similar financial bric-a-brac—a massive exchange of paper for paper.

The Fed got into the “quantitative easing” racket in 2008 and, by all accounts, having painted itself into a corner, is looking for an easy way out—but none, apparently, exists. Every time the Fed tries to unload some of its securities, it spooks the financial markets.