The macroeconomic situation in Japan seems to be coming to a head. When the Bank of Japan, under its President Haruhiko Kuroda, announced on December 20, 2022, that it would raise its interest rate ceiling on ten-year Japanese government bonds from 0.25 percent to 0.50 percent, share prices in Tokyo plummeted and the Japanese yen appreciated sharply.

The “Kuroda shock,” which in the eyes of some observers heralded a turning point in Japan’s thirty-year low, zero, and negative interest rate policy, sent shock waves through the international financial markets. Meanwhile, the markets are betting against the Bank of Japan being able to keep its self-imposed interest rate ceiling. Is Japan heralding an end to low inflation and low interest rates? We have examined the Japanese model and see some evidence for this.

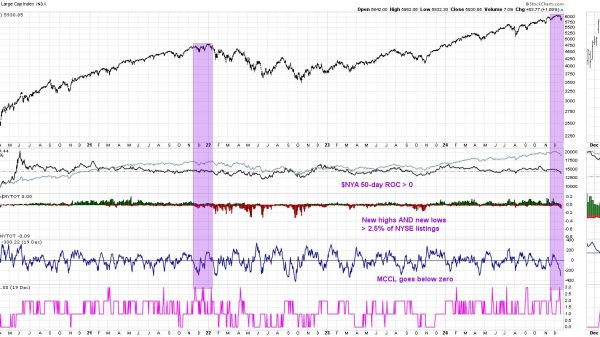

Figure 1: Bank of Japan key interest rate, stock, and property prices

Source: Macrobond.

The East is ahead of us not only in time of day, but sometimes also in time of history. A head start of a different kind occurred when the Japanese “bubble economy” burst in the late 1980s. Overly loose monetary policy had created a bubble in the stock and property markets in the second half of the 1980s (see figure 1). As the Bank of Japan kept cutting interest rates in response to the bursting bubble from the early 1990s onward, an environment of low inflation combined with meagre economic growth emerged. The low growth–low inflation environment only reached the West after almost two decades because of the global financial crisis of 2007/8.

Japan was not always a country of low inflation and interest rates. During the period of the Bretton Woods exchange rate system (1944–73), in which the yen was firmly pegged to the US dollar, inflation in Japan—driven by the economic catch-up process—was higher than in the US. After the collapse of the Bretton Woods system in the early 1970s, inflation rose to more than 25 percent during the oil price shock of 1973/74.

From the early 1980s, inflation in Japan also fell in the wake of the global slowdown, while Japanese stock and property prices exploded in the second half of the 1980s. After this asset-price bubble burst, the Japanese model of low inflation, low interest rates, and low growth emerged. It has four elements:

First, since the 1990s, the Bank of Japan’s interest rate cuts, extensive government stimulus programs, and a growing mountain of subsidized loans to ailing companies have prevented not only a major recession but also the adjustment of outdated structures. The resulting zombification of many Japanese companies led to low growth, declining real wages, and thus low inflationary pressure from the demand side.

Second, low inflation over a long period of time depressed the inflation expectations of all economic agents, while seemingly cemented low interest rates blurred the difference between hoarding money (in liquid bank deposits) and saving money (in financial assets). The Bank of Japan was able to finance rising government debt through money issuance without risking a loss of confidence in money.

Third, the state helped cement low inflation by keeping the prices of an increasing number of goods and services low through subsidies. The government was able to raise the funds for the subsidy payments through new debt without raising interest rates. This is because the Bank of Japan was able to turn many government bonds into money that people were willing to hold. Meanwhile, the national debt is about 260 percent of gross domestic product, while about 50 percent of the outstanding Japanese government bonds are held by the Bank of Japan.

Fourth, the financing of rising public debt through money issuance and hoarding came at the expense of riskier investments. The stock and real estate markets, corporate investment, and economic growth languished for a long time. Even the “Abenomics” starting in 2013 did not bring about a turnaround. Despite an unprecedented flood of money, neither growth nor inflation returned to the levels seen before the bubble burst.

The Japanese model not only pioneered the global low inflation and low interest rate environment, but it was also supported by it until the recent past, because all other industrialized countries kept interest rates very low as well. Yet, with the steep rise in inflation in the US and many other Western industrialized countries, this support has fallen away. The yen came under depreciation pressure as the Fed, European Central Bank, and many other central banks increased interest rates. The weaker yen reinforced inflationary pressures in Japan.

In principle, the Japanese government could counter the latest rise in inflation to 3.8 percent in November 2022 in the tried and tested manner of extending price subsidies. The price would be more government debt, which would have to be financed with even more money issuance. But this would only work if the inflation expectations of economic agents remained firmly anchored at a low level and their willingness to hoard money remained unwavering. Trade unions would have to remain cautious on wage demands despite higher inflation, for example, due to fears of large-scale restructuring of Japanese zombie companies. However, surveys by government agencies show that most consumers expect prices to rise over the year. Wages and prices seem to be following expectations.

Figure 2: Inflation, wage changes, and inflation expectations

Source: Macrobond. Wage changes for Tokyo smoothed. Inflation expectations is defined as the share of respondents expecting higher prices over the year minus the share of respondents expecting prices to stay the same or fall.

Consequently, an alternative development is coming into focus. Higher inflation expectations could now fuel wage demands against the backdrop of labor shortages in the rapidly ageing Japanese society after many years of wage austerity. Rising wage cost pressures and a weak currency could lead to a spiral of higher inflation and higher inflation expectations. With government debt already very high, the state could be overburdened to keep prices down with subsidies. If the Bank of Japan had to counter the rise in inflation with significant interest rate hikes, it would not only suffer substantial losses on its securities holdings, but other financial institutions such as banks, insurance companies, and pension funds could get into trouble. Japan’s numerous zombie companies, which have so far survived thanks to low interest rates and wage restraint by the unions, would be in trouble.

Ultimately, the government would be faced with the choice of allowing higher inflation up to hyperinflation to devalue the abundant national debt and the money overhang it has generated. Or it would eliminate this overhang through economic and monetary reform. Should the government seek templates for the reduction of debt, economic history offers a broad spectrum of case studies. Particularly, German history after the First and Second World Wars as well as the liquidation of the German Democratic Republic during German reunification offer rich illustrative material.