It’s always better to be optimistic than pessimistic. It’s always better to be swinging the hammer, rather than being the nail. When should we sell stocks so we don’t become the nail? Is it bad to recommend selling stocks?

Behavior repeats over and over, and that is why we see chart patterns repeat. Fear and Greed. Rallies and market drops. Bull markets, bear markets, rallies and pullbacks, price patterns repeat. Investors show their cards with the price action, not the news.

One of the difficulties in the market today is staring into the winds of danger created by the highest interest rates in 15 years. I recently went through a selection of homebuilder charts, but the biggest thing that showed up to me was the similarity to the chart shapes back in 2006 -2007 the rolled into the last big bear market. Back then investors also hoped for a soft landing. It didn’t work out that way, so can we learn by looking at the charts now compared to then?

Housing starts have been dropping and the meaningful drop below the 40-month moving average is what got me interested.

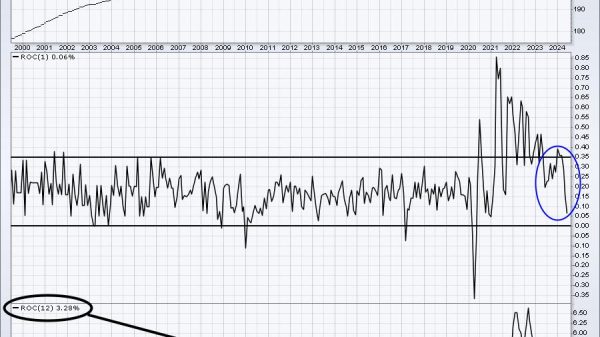

On the chart below, I put the Fed funds rate data at the bottom. Ignoring the sudden freeze by COVID, there have only been two major trips below the green line in the last 40 years. Both of those involved large interest moves higher by the Fed. Not all moves by the Fed create a problem, so we can justify the price action until we are wrong. For me, these bullet points look accurate.

Large breaks below the green line should be taken seriously.When the PPO on the center panel is below zero, this chart suggests that the housing data is problematic. This isn’t just a regular pullback. It looks like a problem. Usually this is a multi-year problem according to the chart.The Fed rate increase is the steepest 12 month rate of change increase on the chart, shown in green on the Fed Rate Panel. No, that is not an error! As of Friday morning (Feb 24,2023), the market is now pricing in a Fed Funds rate of 5.36% which will be higher than 2007.It took the Fed three years to get to 5.25%. This move is going to get us there in half that time and double the distance.

Mortgage applications have been dropping as interest rates rise. This also suggests a slowdown in housing.

Since October, homebuilders have been on the rise. Even the TV commentary is still bullish. But it is way more important to watch what investors do with their money, which is why we use charts.

Toll Brothers – TOL

Here is Toll Brothers currently. Apparently, the CEO said everything is going well. I have never heard a CEO say sell my stock.

What I am noticing is the PPO was below zero and has rallied back above. That is bullish. However, this is the most critical place on the chart. This is a run for the highs again after a huge run up. Can it continue?

The full Stochastic is now dropping below 80 so its time to focus on this run as we head into March. What is the seasonality of this?

Here is Toll Brothers (TOL) back in 2006 and the chart rolled over in March 2007.

If the chart above was to play out similarly:

Price would break the uptrendThe PPO would start to roll over onto a sell signal.The full stochastic would continue dropping.

Hovnanian – HOV

Here is the 2023 chart for Hovnanian. HOV

Looking back at 2006, we saw a similar run up heading into March 2007.

What I would recommend is to watch how these charts play out. Do they repeat the chart pattern of 2007 in the face of 2023 Fed Funds interest rate rising higher than 2007 Fed rates? It’s time to watch closely.

My strength indexes can rally at any time, and they are in the buy zone. When they turn up, we’ll be ready for a rally like the one that started in January. Until then, caution is warranted. The situation looks more like November 2021, where the market slowly rolled over, but the strength indexes continued to get weaker.

Would you have liked to get notified three weeks ago that the market was getting weak? To stay on top of all of this movement, check out our offers on Osprey Strategic. A starting rate is $7 for the first month.