The taming of monetary policy necessary to slow price inflation has triggered a corrective trend in the valuation of financial instruments. Many big banks in the United States have substantially increased their use of an accounting technique that allows them to avoid marking certain assets at their current market value, instead using the face value in their balance sheet calculations. This accounting technique consists of announcing that they intend to hold such assets to maturity.

As of the end of 2022, the bank with the largest amount of assets marked as “held to maturity” relative to capital was Charles Schwab. Apart from being structured as a bank, Charles Schwab is a prominent stockbroker and owns TD Ameritrade, another prominent stockbroker. Charles Schwab had over $173 billion in assets marked as “held to maturity.” Its capital (assets minus liabilities) stood at under $37 billion. At that time, the difference between the market value and face value of assets held to maturity was over $14 billion.

If the accounting technique had not been used the capital would have stood at around $23 billion. This amount is under half the $56 billion Charles Schwab had in capital at the end of 2021. This is also under 15 percent of the amount of assets held to maturity, under 10 percent of securities, and under 5 percent of total assets. An asset ten years from maturity is reduced in present value by 15 percent with a 3 percent increase in the interest rate. An asset twenty years from maturity is reduced in present value by 15 percent with a 1.5 percent increase in the interest rate.

The interest rates for long-term financial instruments have remained relatively stable throughout the first quarter of 2023, but this may be subject to change as many of the long-term assets of recently failed Silicon Valley Bank and Signature Bank must be sold off for the Federal Deposit Insurance Corporation to replenish its liquidity. The long-term interest rate is also heavily dependent on inflation expectations, as with higher inflation a higher nominal rate is necessary to obtain the same real rate. It is also important to remember that the US Congress has persisted in not raising the debt ceiling for the government, which is currently projected to not be able to meet all its obligations by August. This could impact the value of treasuries held by the banks.

Other banks that may be close to an effective insolvency include the Bank of Hawaii and the Banco Popular de Puerto Rico (BPPR). The Bank of Hawaii’s hypothetical shortfall as of the end of 2022 already exceeded 60 percent of its capital. The BPPR has over double its capital in assets held to maturity. All three banks—Bank of Hawaii, BPPR, and Charles Schwab—have lost between one-third and one-half of their market capitalization over the last month.

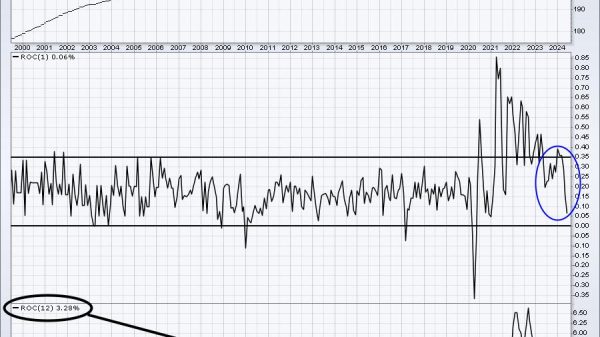

It is difficult to say with certainty whether they are indeed secretly close to insolvency as they may have some form of insurance that could absorb some of the impact from a loss of value in their assets, but if this were the case it is not clear why they would need to employ this questionable accounting technique so heavily. The risk of insolvency is currently the highest it’s been in over a decade.

Central banks can solve liquidity problems while continuing to raise interest rates and fight price inflation, but they cannot solve solvency problems without pivoting monetary policy or through blatant bailouts, which could increase inflation expectations, exacerbating the problem of decreasing valuations of long-term assets. In the end, the Federal Reserve might find that the most effective way to preserve the entire system is to let the weakest fail.