WASHINGTON — Wall Street executives who have advised the US Treasury’s debt operations for the past 25 years warned on Tuesday they are “deeply concerned” about the debt limit impasse that has markets worried about a US default on payment obligations.

The 18 current and former chairs and vice chairs of the Treasury Borrowing Advisory Committee (TBAC) since 1998 said in a letter to Treasury Secretary Janet Yellen, “Any delay in making an interest or principal payment by Treasury would be an event of seismic proportions, not only for financial markets but also the real economy.”

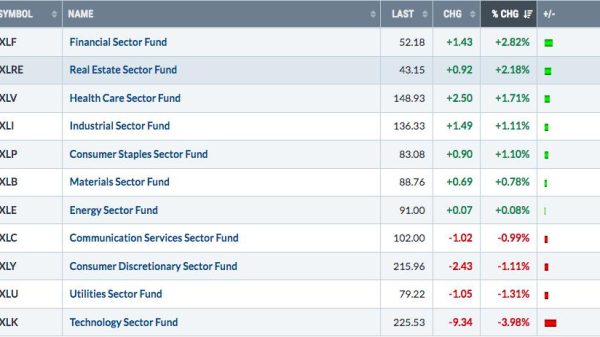

The advisers said the standoff between Republicans and Democrats in Congress and the White House has already raised taxpayer borrowing costs through weak Treasury auctions and high yields for short-dated Treasury Bills, while ratings agencies are already publishing analyses of potential US ratings downgrades.

“There will be a direct impact on any issuer whose credit relies on backing from the US government,” such as mortgage entities Fannie Mae and Freddie Mac, municipal issuers or Amtrak and the Tennessee Valley Authority. “A US government downgrade or default would surge broadly throughout the real economy.”

They said the Treasury market’s role as the backbone of the entire financial system would be called into question, leaving the debt market without a benchmark pricing firm and causing investors to pull back from fixed-income and equity markets.

“The validity of Treasuries as eligible collateral for margin would be called into question, with devastating consequences for interest rate derivative, commodity, and mortgage markets,” wrote the chairs, led by current TBAC chair Beth Hammack of Goldman Sachs GS.N and vice chair Deirdre Dunn of Citigroup C.N.

Their letter was distributed after President Joseph R. Biden met with Republican House of Representatives Speaker Kevin McCarthy at the White House with no signs of softening their positions, though they agreed to continue talks.

The advisers said that following the banking turmoil that started in March, the debate over raising the debt limit is “reckless and irresponsible.”

A protracted negotiation would have short-term costs, but a default is an “unthinkable” event, the executives said. “The magnitude of adverse consequences from a prolonged negotiation, or a default, is unquantifiable, with both the American taxpayer and the U.S. economy bearing the burden,” they wrote. — Reuters