Whether you’re considering selling a portion of your equity or your entire company, it’s essential to prepare your business effectively.

Much like selling a house, the process of selling a business involves highlighting its potential, fixing any weaknesses, and ensuring it’s presented in the best possible light.

Potential buyers will undoubtedly want to conduct their own due diligence before committing to a purchase. This is a crucial step in the transaction process, providing transparency and building trust.

“Due diligence is about demonstrating the value of your business transparently and honestly.” – Anonymous

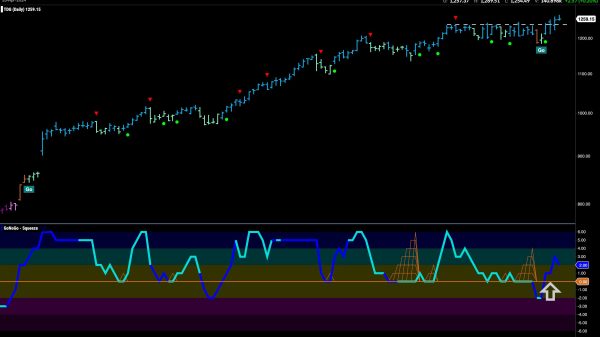

The financial preparation for selling a business is multifaceted. From ensuring that your books are in order to demonstrating profitability, it’s about showing potential buyers that your business is a sound investment.

Your business’s profitability is the first thing that potential buyers will assess. They’ll want to see consistent revenue growth and a strong bottom line.

Maintaining clean and organised financial records is crucial. These should include your balance sheet, income statement, and cash flow statement.

Legal Preparation

Before selling your business, it’s important to have all your legal documents in order. This includes any contracts, leases, licenses, and insurance policies.

Operational preparation involves ensuring that your business can run without you. This means having a solid team in place, streamlined processes, and a clear business plan for the future.

Marketing Your Business

When you’re ready to sell, it’s time to market your business. This involves creating a compelling sales memorandum, listing your business on relevant platforms, and engaging with potential buyers.

The negotiation process is where the price and terms of sale are agreed upon. It’s crucial to approach this with a clear strategy and a firm understanding of your business’s worth.

Finalising the Deal

The final stage in selling your business is finalising the deal. This typically involves signing a sales agreement and transferring ownership to the new owner.

Post-Sale Considerations

After the sale, it’s important to consider any post-sale obligations. This may include a handover period, non-compete clauses, or consultancy agreements.

Preparing your business for sale can be a complex and time-consuming process. However, with the right preparation, it can also be an exciting and rewarding journey. It’s about understanding what potential buyers are looking for, presenting your business in the best possible light, and negotiating a deal that’s beneficial for all parties involved.

Whether you’re considering selling your business now or in the future, this guide should provide you with a comprehensive understanding of what’s involved. Happy selling!

Read more:

Preparing Your Business for Sale