Government borrowing increased to £8.4 billion in February, marking a notable surge compared to the same month last year, according to official figures released today by the Office for National Statistics (ONS).

This borrowing spike is attributed to various factors, including increased government spending on benefits following inflation-linked adjustments and higher debt interest expenditure. Despite rising expenses, government tax receipts saw a boost of £7.2 billion to £86.4 billion, driven by increased revenues from income and corporation tax.

Year-to-date, the government has accumulated a deficit of £106.8 billion, lower than the same period last year. However, the February borrowing overshoot poses a risk of the government missing the Office for Budget Responsibility’s forecast of £114.1 billion for the full financial year.

Ruth Gregory, deputy chief UK economist at Capital Economics, expressed skepticism about meeting the OBR’s forecast, citing the considerable shortfall required in March to align with projections.

Government borrowing, necessary to cover expenditure exceeding tax revenue, has consistently outpaced spending over the past few months. Jessica Barnaby, a statistician at the ONS, highlighted that February marked the fourth consecutive month of reduced borrowing compared to the previous year, with tax revenue growth outpacing spending growth.

There is speculation surrounding potential budgetary actions by Chancellor Jeremy Hunt and Rishi Sunak in August or September, ahead of an anticipated autumn general election. Further tax cuts are expected to address declining Conservative polling numbers, despite the tax burden reaching a postwar high.

Debt interest spending, although declining slightly in February to £6.8 billion, remains a significant budgetary concern. The Bank of England’s decision to raise the UK base rate to a 16-year high of 5.25 per cent in August 2023 has elevated government bond yields and debt servicing costs.

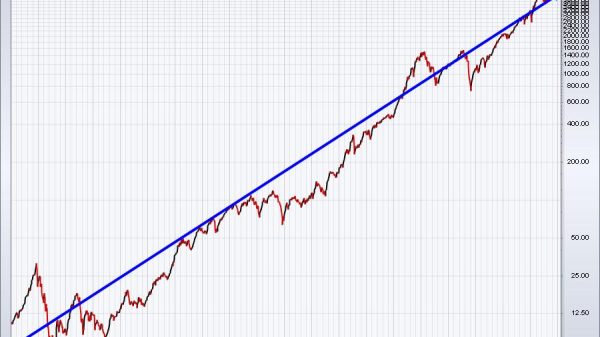

While economic shocks since 2008, including the financial crisis and the COVID-19 pandemic, have necessitated substantial borrowing to support the economy, they have also contributed to a significant increase in the government’s debt-to-GDP ratio, reaching 97.1 per cent, the highest level since the 1960s.

Read more:

Government Borrowing Rises to £8.4 Billion in February