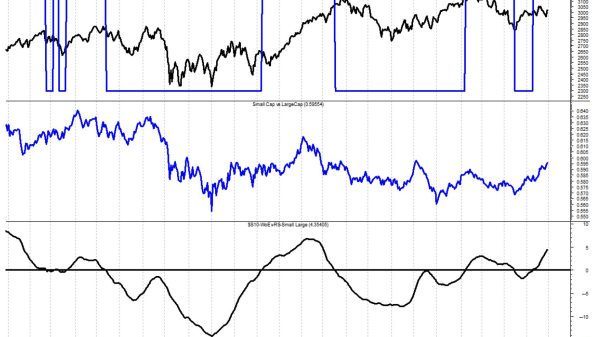

While our major equity benchmarks showed incredible strength in Q1 2024, breadth conditions have been deteriorating since mid-March. Despite the weakening breadth readings, and the initial breakdowns of the S&P 500 and Nasdaq 100, leading growth names, including the formerly-described Magnificent 7 stocks, had remained in clearly-defined uptrends.

This week, some of the top-performing stocks in the S&P 500 finally broke below their 50-day moving averages. While this signal on its own is not a sign of a market top, these breakdowns represent just one of the many clear signals that the bull market off the October 2023 low may be over.

Today, we’ll briefly review some of the early breakdowns in the mega-cap growth space, how some of the top-ranked SCTR stocks have shown recent weakness, and why the “Fantastic Four” (current front-runner to replace the “Magnificent 7 moniker) breaking down may represent a key confirmation for a new bear phase.

The Early Breakdowns: Apple (AAPL) & Tesla (TSLA)

Tesla has been in a confirmed downtrend since July 2023, and Apple has appeared in a weak technical configuration since failing to break above the $200 level in December and January. But both charts have literally and figuratively made a new low this week.

Note how both charts have remained below downward-sloping 50-day moving averages since mid-January. Also observe how both have shown failed attempts to break above that moving average in recent months. When stocks are making lower lows and lower highs, and trending below downward-sloping moving averages, I’ve learned it’s best to avoid taking action until some of those conditions start to change.

Ready to talk market breadth indicators? Our next free webinar, Breaking Down Breadth, will focus on breadth conditions now vs. previous market tops. Join me on Tuesday, April 23rd at 1pm ET as we review the current market environment through the lens of breadth indicators, compare them to conditions at previous market tops, and discuss the likelihood of further drawdowns for the S&P 500 and Nasdaq. Sign up HERE for this free webcast!

As these stocks broke down, diverging from most other leading growth names, the S&P 500 and Nasdaq 100 pushed much higher. So let’s see some of the stocks that served as leadership in Q1.

The Top-Ranked SCTRs: Super Micro Computer (SMCI) & MicroStrategy (MSTR)

Here, we have two names that were less well-known until they experienced exponential gains earlier this year. And while they certainly appeared overextended in March, they have now both come right down to earth.

From the end of 2023 to their peaks in March 2024, SMCI and MSTR gained 350% and 175%, respectively. They both were a far distance from moving average support, giving clear signs of overbought conditions. So far in April, both stocks have traded much lower, and they each finished this week below their 50-day moving averages.

It’s normal for stocks in strong uptrends to pull back and test moving average support. Indeed, the 50-day moving average often serves as a potential entry point for a “buy on the dips” strategy. But when top performers fail to hold this crucial short-term support level, I have found that it often implies a broader move to more risk-off positioning.

What about the best of the biggest–in other words, the most magnificent of the Magnificent 7?

The Fantastic Four Breakdowns: Netflix (NFLX) & Amazon (AMZN)

That brings us to perhaps the most concerning development this week. As I recently posted on my social media accounts, “As long as $AMZN and $NFLX remain above the 50-day moving average, you can make an argument for ‘short-term pullback’ as opposed to ‘protracted and painful decline.'” Unfortunately, this week, we finally observed this breakdown of breakdowns.

Mega-cap growth stocks wield an outsized influence on our top-heavy growth-dominated equity benchmarks. In recent weeks, bearish momentum divergences, weakening breadth conditions, and breaks of “line in the sand” support levels had us thinking market weakness over market strength. But the resilience of the Fantastic Four stocks gave us just a glimmer of hope that a pullback may be limited.

Given this week’s breakdown in the charts of previous top performers, we feel this just may be the beginning of the great bear phase of Q2 2024.

RR#6,

Dave

P.S. Ready to upgrade your investment process? Check out my free behavioral investing course!

David Keller, CMT

Chief Market Strategist

StockCharts.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.

The author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.