Burberry is set to cut up to 1,700 jobs — nearly 18% of its global workforce — as part of a sweeping cost-saving plan aimed at stabilising the business after a sharp downturn in the global luxury market pushed it into a pre-tax loss of £66 million.

The iconic British fashion house announced the measures on Wednesday, with the majority of cuts expected to come from head office functions, particularly in London, over the next two years. Additional reductions will come from operational changes at its Castleford factory in West Yorkshire, where the night shift will be scrapped and staff rotas reorganised.

The move is part of a cost-cutting strategy led by new chief executive Joshua Schulman, who joined in July with a mandate to turn the company around. The plan aims to deliver £60 million in new savings, bringing total annualised savings to £100 million by the end of 2027.

Despite the scale of the cuts, Schulman — a luxury industry veteran with past roles at Jimmy Choo and Coach — maintained a confident tone. “I’m more optimistic than ever that Burberry’s best days are ahead,” he said, though he acknowledged the increasingly uncertain macroeconomic environment, driven in part by geopolitical instability.

Investors appeared reassured, with shares in the FTSE 250 company rising 8.1% to 894p in morning trading.

For the financial year to 29 March, Burberry reported a 12% decline in like-for-like sales to £2.5 billion, alongside a sharp swing from a £383 million profit the year before to a £66 million loss. While the figures reflect the impact of broader industry pressures, they were not as severe as some analysts had feared.

The company has been hit hard by falling demand in China, one of its most important markets. Sales in mainland China dropped by 15% over the year, with an 8% fall in the fourth quarter alone. The global Chinese customer group also declined by a mid-single-digit percentage year-on-year.

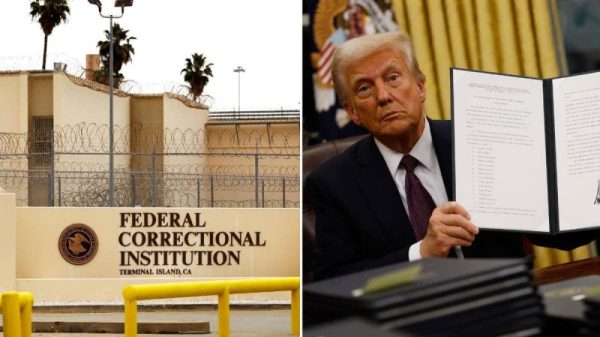

Trade tensions have added to the headwinds. President Trump’s sweeping tariffs on luxury goods escalated the ongoing trade war with China, creating fresh uncertainty for brands reliant on global demand. A 90-day truce between the US and Beijing announced this week has offered a glimmer of hope that tensions may ease.

Schulman’s “Burberry Forward” strategy aims to refocus the brand on its most iconic products — including trench coats and scarves, which retail between £420 and £2,500 — while also broadening its pricing structure to appeal to a wider consumer base.

As the global luxury sector adjusts to a more cautious consumer landscape and rising political volatility, Burberry’s restructuring signals a tough but necessary repositioning. The brand now faces the challenge of reigniting growth while staying true to its British heritage — and doing so with a leaner, more focused workforce.

Read more:

Burberry to cut 1,700 jobs in global savings drive amid luxury slowdown