Miami-based alternative investment firm HIG Capital has launched a self-storage platform in Italy, marking its third European market entry in the sector following established operations in the United Kingdom and Germany.

The firm completed acquisitions of five facilities across Milan and Rome, signaling continued confidence in European real estate opportunities despite broader market uncertainty.

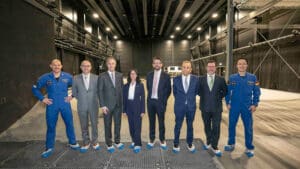

The platform, branded as Boxengo, will open its first two Milan locations before year-end, with three additional sites—two in Milan and one in Rome—scheduled to begin operations throughout 2026. Industry veteran William Binella, who brings more than 25 years of sector experience, will lead the new venture as chief executive officer.

HIG Capital, founded in 1993 by Sami Mnaymneh and Tony Tamer, manages $70 billion in capital across multiple investment strategies. The firm has increasingly directed resources toward operationally intensive real estate sectors where supply constraints create attractive returns. Self-storage fits this profile, particularly in densely populated European metropolitan areas where residential space limitations drive demand for auxiliary storage solutions.

HIG Capital’s Real Estate Strategy Takes Shape

The Italian expansion reflects a broader pattern in HIG’s recent dealmaking. Over the past year, the firm has pursued value-add real estate opportunities across Europe, including logistics facilities in France and life sciences campuses in Cambridge. These investments share common characteristics: undersupplied markets, operational complexity, and potential for value creation through active management rather than financial engineering alone.

Self-storage presents specific advantages. The sector demonstrated resilience during economic downturns, as consumers and businesses require storage during relocations, downsizing, or business transitions. Italy’s fragmented market offers consolidation opportunities, while urban density in Milan and Rome creates natural demand centers. Unlike commercial office space, which faces structural challenges from remote work trends, self-storage occupancy rates have remained stable across European markets.

Riccardo Dallolio, managing director and head of HIG Realty in Europe, characterized self-storage as “operationally intensive and undersupplied,” suggesting the firm sees room for both market consolidation and operational improvements. Alessio Lucentini, managing director and head of asset management for HIG Realty in Europe, emphasized building “a next-generation, operationally innovative self-storage platform built on high-quality assets.”

Broader Market Context

HIG’s Italian move comes as private equity firms face pressure to deploy capital in an environment where traditional leveraged buyouts have become more expensive. Rising interest rates have increased financing costs, while economic uncertainty has complicated exit timing. Real estate, particularly in niche sectors like self-storage, offers an alternative path: lower leverage requirements, predictable cash flows, and longer hold periods that align with current market conditions.

The firm’s recent activity extends beyond real estate. HIG completed the $400 million acquisition of 4Refuel, a mobile refueling company, in July 2025. Earlier in the year, the firm merged technology solutions providers Converge and Mainline into a new entity called Pellera Technologies, creating a $4 billion revenue platform. The firm also launched a GP Solutions Platform focused on secondary market transactions, hiring a team from Morgan Stanley’s private equity unit.

These moves suggest HIG is pursuing a multi-pronged strategy: consolidating fragmented industries, executing corporate carve-outs, and building platforms that benefit from operational expertise rather than financial leverage alone. The approach appears calculated to navigate an uncertain exit environment while maintaining deployment pace.

Italy’s self-storage market remains less developed than counterparts in the U.S. or U.K., where per-capita availability exceeds European averages by substantial margins. This gap represents opportunity for early movers who can establish brand recognition and operational scale before competition intensifies. Boxengo’s focus on Milan and Rome targets the country’s largest metropolitan areas, where population density and real estate prices create favorable conditions for the business model.

Whether HIG can successfully transplant operational practices from its U.K. and German platforms to Italy remains to be seen. Each market presents distinct regulatory environments, consumer behaviors, and competitive dynamics. Success will likely depend on execution—site selection, pricing strategy, and the ability to scale efficiently while maintaining service quality.

The firm’s track record suggests confidence in this formula. Since 1993, HIG has invested in more than 400 companies worldwide, with a current portfolio exceeding 100 companies and combined sales surpassing $53 billion. The Italian self-storage venture represents another test of whether operational expertise can drive returns in markets where financial engineering has become less reliable.

Read more:

HIG Capital Expands European Self-Storage Portfolio with Italian Market Entry