One of Britain’s biggest DIY investment platforms has warned that prolonged budget speculation inflicted real financial damage, after savers rushed to drain about £600 million from their pensions amid fears Rachel Reeves would slash tax-free lump sum rules.

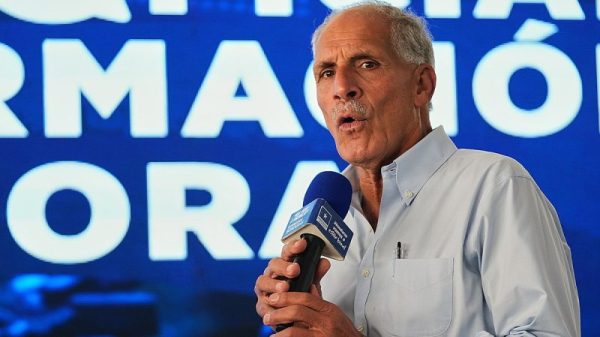

Michael Summersgill, chief executive of AJ Bell, said months of rolling briefings and hints of a tax raid had prompted thousands of customers to make precautionary withdrawals in September and October, convinced the Treasury was preparing to cap the 25% tax-free pension commencement lump sum.

Under current rules, savers aged 55 and over can withdraw up to £268,275 tax-free. Reeves ultimately chose not to touch the allowance, but Summersgill said the period of uncertainty had again shaken confidence.

“We saw the same pattern last year when similar fears led to £300 million of early withdrawals,” he said. “Speculation alone can be damaging, and this year has been no exception.”

While the Treasury backed away from altering pension lump sum rules, it did press ahead with controversial changes to the Isa system, and Summersgill did not mince his words.

From April 2027, savers under 65 will only be allowed to put £12,000 per year into cash Isas, even though the overall £20,000 annual allowance remains unchanged. The government intends the remaining £8,000 to flow into stocks and shares Isas to boost investment in UK markets.

But in a move that shocked many in the industry, HMRC will also impose a new tax charge on interest earned on uninvested cash held within stocks and shares Isas by under-65s. Transfers from stocks and shares Isas into cash Isas will be banned to prevent workarounds.

Summersgill called the changes “the polar opposite of simplification” and said the interest charge was “just crazy, so unhelpful”.

“How the government has got this lost along the way, I do not know,” he added. “There is nothing positive about the interventions being proposed.”

AJ Bell reported a 22% rise in pre-tax profits to £137.8 million for the year to 30 September, with revenues up 18% to £317.8 million. Platform assets hit a record £103.3 billion, helped by £7.5 billion of net inflows and £9.3 billion of market gains.

But shares fell 7.6% after the firm said it would step up spending by more than £15 million in the coming year to accelerate growth, funding new technology, marketing and additional engineering hires.

Summersgill said the increased investment was vital: “There’s a huge growth opportunity. I’m not doing my job if we don’t invest aggressively to capture it.”

The company expects pre-tax margins to ease to around 39–40% in 2026, down from 43.4% this year, reflecting the ramp-up in spending.

Read more:

AJ Bell hits out at ‘crazy’ Isa overhaul as tax fears trigger £600m pension exodus