The Complete Trader, which we have featured in previous Dailys, is one of my favorite go-tos for trading ideas.

The columns help determine the trade setup. For example, an “Inside Day” that is also in a bullish stock phase. Also a narrow range that shows a narrower trading range than the prior four days’ ranges.

I like to use it based on market conditions. So, I will look at bullish compression, for example, if the overall market is holding support. And I also like to look at sectors that are setting up if those sectors are in alignment with the market and any new economic data.

Today, CPI came in basically as expected. With my bias towards consumers buying more of what they need, I like the area of consumer staples.

The first 3 of 4 picks are consumer staple companies: Conagra Brands (CAG), Pepsico Inc (PEP) and Proctor & Gamble (PG). These featured stocks are for educational purposes only and not buy recommendations. Trading involves risk, and we use specific risk parameters with profit targets for every trade we make.

CAG, at the time of writing, has a second inside day potential. That means investors have paused, which makes sense given the heavy data week. We like to watch range breaks after multiple inside days.

The price is above the 50- and 200-day moving averages. The Real Motion indicator is in line with price, so there is no divergence. The risk, if you like moving averages as lines in the sand, is clear.

PEP had a golden cross of the 50- and 200-DMAs at the start of April. The price might be a bit extended as we look at distance from major moving averages to ascertain if we like the risk/reward.

Real Motion has had a mean reversion right at the top prints of 185. Nonetheless, the price action is worth watching.

PG recently had a golden cross. Like PEP, real motion indicates a mean reversion. Both PEP and PG would be more attractive to us if the price drops closer to the moving averages to control risk.

Nonetheless, 3 takeaways:

Price Compression in good phasesMomentum and distance from MAsStrong Sector-seeing the best Risk/Reward

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

IT’S NOT TOO LATE! Click here if you’d like a complimentary copy of Mish’s 2023 Market Outlook E-Book in your inbox.

“I grew my money tree and so can you!” – Mish Schneider

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish joins Bob Lang of Explosive Options for a special webinar on what traders can expect in 2023!

Rosanna Prestia of The RO Show chats with Mish about commodities, macro and markets.

Mish talks opportunites in the market in this appearance on Business First AM.

Mish and Charles Payne rip through lots of stock picks in this appearance on Fox Business’ Making Money with Charles Payne.

Mish talks Beyond Meat (BYND) in this appearance on Business First AM.

In this guest appearance on the Madam Trader podcast, recorded March 20, Mish shares her journey from special education teacher to commodoties trader and now trading educator. Hear her insights on the spring 2023 market conditions and how to harness the right skills to succeed.

Follow Mish as she breaks down current market conditions for her friends across the pond on CMC Markets.

Mish talks about Dominion Energy with Angela Miles in this appearance on Business First AM.

Coming Up:

April 13th: The Final Bar with David Keller on StockCharts TV and Twitter Spaces with Wolf Financial and Twitter Spaces with Mario Nawfal

April 19th: Closing Bell on Cheddar TV

April 20th: Benzinga Pre-Market Prep

April 24-26: Mish at The Money Show in Las Vegas

May 2-5: StockCharts TV Market Outlook

ETF Summary

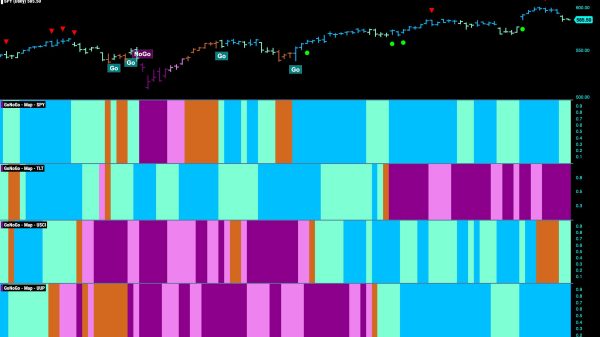

S&P 500 (SPY): 405 support, 410 pivotal over; a weekly close over 412.35 positive.Russell 2000 (IWM): 170 support, 180 resistance.Dow (DIA): Over some recent consolidation so watch 336 to hold.Nasdaq (QQQ): 312 support, over 320 better.Regional banks (KRE): 41.28 March 24 low held; now has to clear 44.Semiconductors (SMH): 258 resistance with support at 250.Transportation (IYT): 219-228 the wider range to watch.Biotechnology (IBB): 130 major pivotal area.Retail (XRT): Becoming a troublesome area, so before we get too giddy, needs to hold 59.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education