Boohoo, the online fashion retailer known for its diverse portfolio of brands including Debenhams and Pretty Little Thing, is grappling with significant financial challenges as its losses soar and sales plummet.

The company reported a staggering 76% increase in losses, amounting to £160 million, alongside a 13% decline in sales to £1.8 billion for the fiscal year ending in February.

John Lyttle, Boohoo’s CEO, attributed the company’s struggles to challenging market conditions characterized by high inflation levels and weakened consumer demand. In response, Boohoo plans to implement cost-saving measures amounting to £125 million, including increased automation in its Sheffield warehouse and the closure of a facility in Daventry.

The company’s woes are further compounded by a reduction in its customer base, with an 11% decrease in active users on its platform, each spending less and visiting less frequently. Boohoo’s finance director, Stephen Morana, highlighted intensified competition from traditional retailers expanding online, as well as emerging players like Shein.

To mitigate its losses, Boohoo significantly slashed investments in brands such as Warehouse, Oasis, Wallis, and Dorothy Perkins, redirecting their sales through the Debenhams platform. This strategic shift resulted in a £22.4 million write-off related to the devaluation of these brands, acquired from the collapse of Philip Green’s Arcadia Group in 2021.

Despite the challenges, Morana emphasized Boohoo’s robust balance sheet, with £130 million in property assets and a stake in Revolution Beauty. Additionally, the company witnessed improved trading performance in the second half of the fiscal year, with core brand sales declining by just 4%.

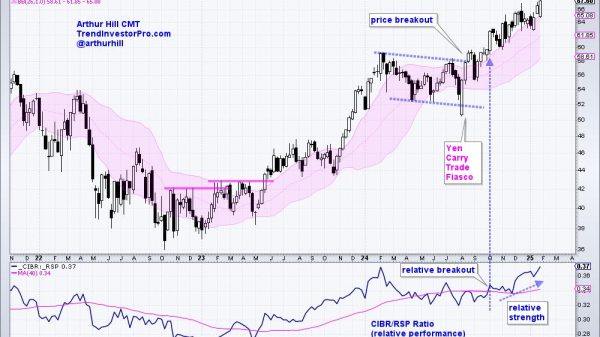

Boohoo’s stock price, however, has experienced a significant decline, signaling investor concerns about its future prospects. The company’s failure to meet performance targets also impacted its ability to issue shares to Pretty Little Thing shareholders, including Umar Kamani, the son of Boohoo’s co-founder and chair, Mahmud Kamani.

Looking ahead, Boohoo remains optimistic about its growth potential, focusing on sustainable and profitable expansion strategies. Nonetheless, analysts caution that the company’s tarnished reputation and financial struggles pose significant challenges to its recovery and long-term viability in the highly competitive online retail landscape.

Read more:

Boohoo Faces Financial Strain Amidst Slumping Sales and Increased Debt