Donald Trump has announced new US tariffs on imports from Canada, Mexico, and China, and hinted that the European Union could be next.

While any direct impact on the UK would depend on whether the White House follows through with tariffs on British goods, Trump’s protectionist stance is likely to hit the global economy—and an open, trade-driven country like the UK could feel the pinch. Here’s what to watch for.

Global trade slowdown and the UK economy

Even if UK exports to the US are not immediately targeted, higher tariffs on close economic partners—such as the EU—could discourage international commerce more broadly. That slowdown in global trade volumes may cause:

• Lower economic growth: The UK is a highly open economy and depends on trade flows. If global trade weakens, British businesses in export-oriented sectors could see falling demand.

• Higher inflation pressures: Tariffs typically raise the cost of imported goods, fuelling inflation. Financial markets could price in further interest rate hikes in response—particularly in the US, but with knock-on effects for the UK through intertwined bond markets.

Rising borrowing costs for the government

When investors anticipate higher inflation, US interest rates often rise. Historically, UK government bond yields (gilts) move in tandem with US Treasury rates. If US borrowing costs climb:

• Higher gilt yields: The UK government will have to pay more interest on its debt, pushing up the cost of borrowing and complicating fiscal planning.

• Potential spending cuts: Chancellor Rachel Reeves has self-imposed fiscal rules. If borrowing costs surge, she may be forced to scale back public spending in order to stay on track.

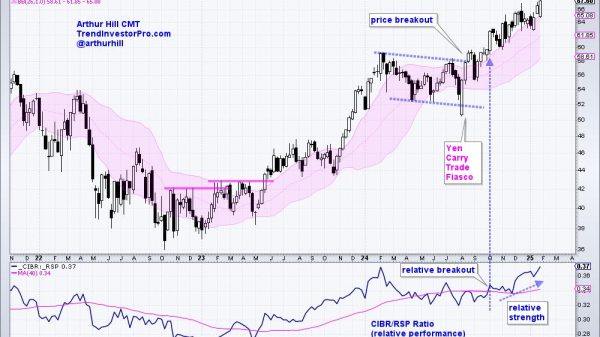

Impact on the FTSE 100

Market sentiment frequently suffers during trade disputes. Weekend trading on brokerage IG’s markets suggests the FTSE 100 could drop when markets open on Monday. That means:

• Investor losses: A weaker FTSE 100 spells poor short-term returns for pension funds and other investors with shares in large British companies.

• Heightened volatility: Global uncertainty could hamper corporate confidence and disrupt plans for investment or expansion.

Balancing us ties with EU ambitions

The UK’s largest trading partner is the EU, and negotiations for a closer relationship—potentially dismantling some post-Brexit trade barriers—are under way. But if the US imposes tariffs on the EU (and vice versa in retaliation), Britain may face tough diplomatic choices:

• Split loyalties: The UK has been making overtures to both the US and the EU. Chancellor Reeves praised Trump’s “optimism” recently, but locking in a stronger UK-EU agreement while placating Washington could become more difficult.

• China’s role: Reeves’s recent visit to China signalled Britain’s interest in open trade relations with Beijing—another sore spot for Washington. The White House may call on allies to support its measures against Chinese imports, complicating the UK’s balancing act.

What if trump targets UK exports directly?

Most British exports to the US are services (finance, consulting, and insurance), which are typically less affected by tariffs than goods. Still, a broad tariff regime could sting:

• Potential loss of £22bn: Analysis by the Centre for Inclusive Trade Policy suggests a hypothetical 20% tariff on all UK exports to the US could mean a £22bn drop in sales, hitting sectors such as fishing and mining especially hard.

• Supply chain uncertainty: Smaller UK manufacturers with integrated supply chains in Europe and North America could be forced to rethink production and export strategies if US access becomes more expensive or unpredictable.

Trump’s trade moves signal a return to the tit-for-tat protectionism seen during his previous term, rattling international markets. While the direct impact on the UK could be limited—especially if Trump’s tariffs focus on different countries—the indirect effects could be significant. Global trade tensions, rising borrowing costs, and renewed diplomatic friction with the EU will test Britain’s economic resilience at a sensitive time, just as the UK is trying to redefine its post-Brexit role in world trade.

Read more:

Donald Trump’s new tariffs: what they could mean for the UK