Disappointing guidance from Walmart (WMT) may have hurt the stock market on Thursday sending the broader indexes lower. But something is churning beneath the surface you don’t want to miss.

There’s a group of stocks that are showing signs of revival after a long period of going nowhere. The industry is close to your heart but the stocks that are gaining ground may surprise you.

Don’t Pass On the Chips

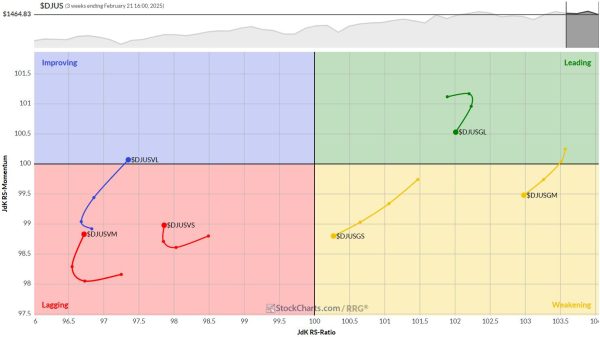

Semiconductor stocks have been on a long sideways trip since mid-October, but that may be coming to an end (see chart below). You can see the semis tried to break out of the sideways range but failed to stay above the range. You can thank DeepSeek for the late January gap down. SMH is now approaching the top of the range again and here’s what’s interesting— it’s not your NVIDIAs, Taiwan Semiconductors, or Broadcoms that are taking the lead in this industry group.

FIGURE 1. DAILY CHART OF THE VANECK VECTORS SEMICONDUCTOR ETF (SMH). Semiconductors have been in a long sideways move since early October 2024. They’ve moved above their trading range a few times but retreated to their sideways range. Chart source: StockCharts.com. For educational purposes.

Since mid-February, the VanEck Semiconductor ETF (SMH) has outperformed the Nasdaq Composite ($COMPQ) by a modest amount. This should be an alert that something is brewing beneath the surface and screams for a deeper dive.

A closer look at the five-day performance of the Semiconductor industry in the StockCharts MarketCarpets shows that the most heavily weighted stock, NVIDIA Corp. (NVDA), gained 6.84%. However, the top three stocks in terms of performance—Wolfspeed (WOLF), Adeia (ADEA), and Peraso (PRSO)—are less weighted stocks and not necessarily household semiconductor names. Seeing these stocks come out of their slump is encouraging.

FIGURE 2. STOCKCHARTS MARKET CARPETS FOR SEMICONDUCTORS. Here, you see the five-day performance of the semiconductor stocks. The table on the right lists the stocks sorted by percentage gain. Image source: StockCharts.com. For educational purposes.

Wolfspeed In the Lead

Let’s look at WOLF’s daily chart. The stock has gained 45.53% in the last five trading days, broke above its 50-day simple moving average (SMA), and is above the upper Bollinger Band®. Trading volume has picked up in the last four months.

FIGURE 3. DAILY CHART OF WOLFSPEED. The stock price has broken above its 50-day SMA and upper Bollinger Band on higher-than-average volume. Chart source: StockCharts.com. For educational purposes.

The price action in WOLF isn’t flashing a buy signal. An uptrend needs to be established as does accumulation. Ideally, you want to see this stock trade above its 200-day SMA. This could take some time but if it does happen, I would add my decision indicators such as the StockCharts Technical Rank and relative strength index (RSI) to confirm the technical strength and momentum in the stock. Once these indicators signal an uptrend is in full swing, I wouldn’t hesitate to open a long position in WOLF.

Adeia Is a Close Second

ADEA, which gained 32.10% in the last five trading days, made a much more aggressive move. The stock price hit an all-time high, is trading well above its 50-day SMA, and volume spiked in the last two trading days. The price move had to do with Adeia’s strong Q4 earnings report.

FIGURE 4. DAILY CHART OF ADEA. The stock price gapped higher on a strong earnings report. A high SCTR score makes this an attractive stock to consider adding to your portfolio and the RSI shows strong momentum. Chart source: StockCharts.com. For educational purposes.

A SCTR score greater than 90 indicates the stock is technically strong and an RSI of 83.10 indicates the stock has momentum. However, given the parabolic move, the stock price is likely to pull back. I would consider the December 16 closing price of around $14.50 to be the first support level. It could break below this price and fade the gap. I’d monitor this chart closely for a “buy the dip” opportunity. A reversal after a pullback with follow-through to the upside would be an ideal entry point for ADEA.

I didn’t find the PRSO chart interesting so will not add it to my StockCharts ChartLists.

Chips Ahoy!

If WOLF and ADEA don’t meet your investing criteria, feel free to go through the table in the MarketCarpet and analyze more charts on the list. You’re bound to find stocks that are within your comfort zone. There’s no end to the number of stocks you can identify with the MarketCarpet and other StockCharts tools.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.